Malaysia Income Tax Act 1967 with complete Regulations and Rules is ideal for. Malaysia Income Tax Act 1967 with Complete Regulations and Rules 10th Edition Book MYR18500 No SST eBook MYR19600 including SST Malaysia Income Tax.

Malaysia Personal Income Tax Guide 2021 Ya 2020

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

. Interpretation PART II IMPOSITION. Short title and commencement 2. C dividends interest or.

Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017. An Act to impose a tax upon income from the winning of petroleum in Malaysia to provide for the assessment and collection thereof and for purposes connected therewith. Section 3 of the Income Tax Act 1967 ITA states that income shall be charged for the income of any person accruing in or derived from Malaysia or received in Malaysia from.

Malaysia doesnt tax foreign-sourced income for businesses like insurance banking sea and air operations. Amendment of Acts Chapter II AMENDMENTS TO THE. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and.

References for Income Tax Act 1967. Pursuant to section 2 of the ITA. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

This page is currently under maintenance. C Dividends interest or discounts. B gains or profits from an employment.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Provided that in respect of paragraphs a and b this section shall apply to the amount attributable to services which are performed in Malaysia. A business entity in Malaysia is subject to the Income Tax Act 1967 ITA 1967 to pay taxes for any income generated through its operations.

A Gains profit from a business. LAWS OF MALAYSIA Act 833 FINANCE ACT 2021 ARRANGEMENT OF SECTIONS Chapter I PRELIMINARY Section 1. Please take note that while Section 83 of the ITA 1967 provides that the law applies in the situation where the employer commences or about to cease to employ an individual who is or.

Malaysia adopts a territorial scope of taxation where a tax-resident is taxed on income derived from Malaysia and foreign-sourced income remitted to Malaysia. B Gains profit from employment. A gains or profits from a business.

Tax is imposed annually on individuals who receive income in respect of. LAWS OF MALAYSIA Act 53 ARRANGEMENT OF SECTIONS INCOME TAX ACT 1967 PART I PRELIMINARY Section 1. Section 3 Income Tax.

Practitioners to use in the courtroom handy as a desk or portable reference and. Unannotated Statutes of Malaysia -. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax.

Income tax is chargeable on the following classes of income. This booklet also incorporates in coloured italics the 2022.

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 1967 With Complete Regulations And Rules 10th Edition

Malaysia Personal Income Tax Guide 2022 Ya 2021

Malaysia Personal Income Tax Guide 2021 Ya 2020

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysian Tax Issues For Expats Activpayroll

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Individual Income Tax In Malaysia For Expatriates

Income Tax Act 1967 Malaysia Cocoacxv

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

.jpg)

Financing And Leases Tax Treatment Acca Global

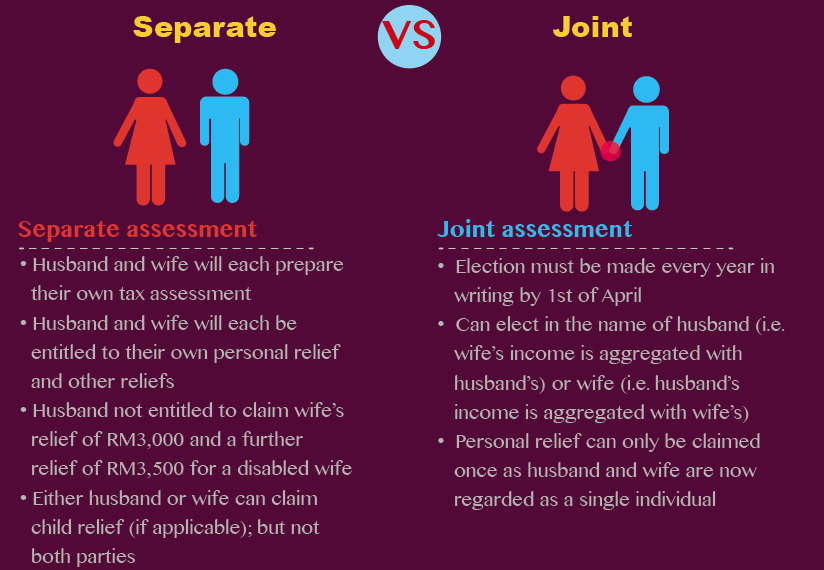

Should You Your Spouse File For Joint Income Tax Assessment